UPDATE

January 30, 2024

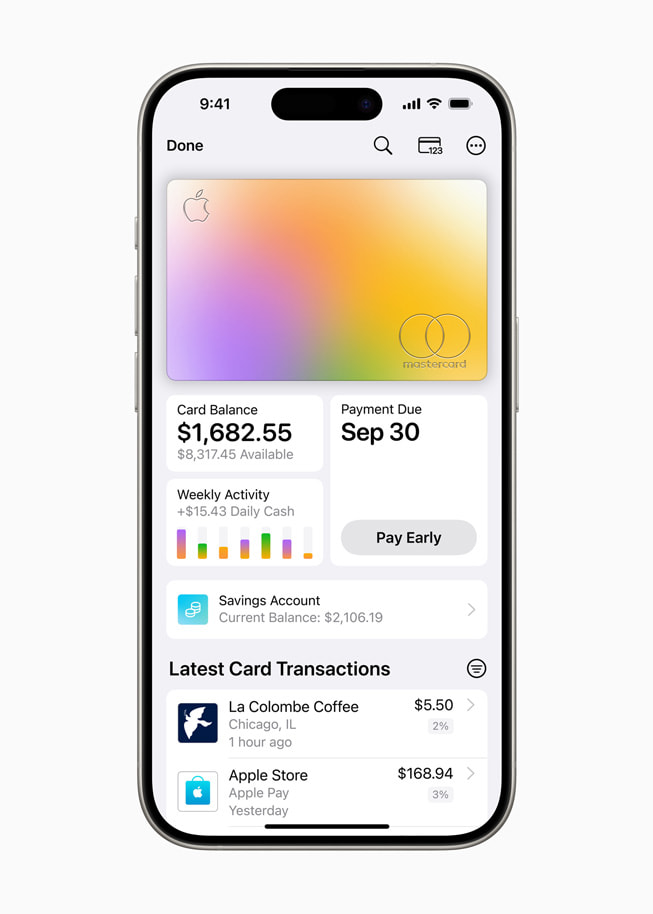

Apple Card is helping more than 12 million cardholders live healthier financial lives

Users earned more than $1 billion in Daily Cash from spending on Apple Card last year

Five years after Apple Card was first introduced in 2019, 12 million Apple Card users are reaping the benefits of Apple Card’s award-winning experience. From easy-to-navigate spending tools, to Apple Card Family, and the recently added Savings account,1 Apple Card continues to reinvent the credit card experience and provide features designed to help users lead healthier financial lives.

“We designed Apple Card with users’ financial health in mind, and it’s rewarding to see our more than 12 million customers using its features to make healthier financial decisions,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “We’re proud of what we’ve been able to deliver to Apple Card customers in just five years. As we look at the year ahead and beyond, we’re excited to continue to innovate and invest in Apple Card’s award-winning experience, and provide users with more tools and features that help them lead healthier financial lives.”

“Since the launch of Apple Card, the customer response has been excellent, and we are pleased that we continue to see users incorporate the innovative tools and features into their financial lives,” said Bill Johnson, Goldman Sachs’s CEO of Enterprise Partnerships in Platform Solutions. “We are committed to continuing to deliver an excellent experience for Apple Card customers.”

Using Apple Card’s digital-first tools and benefits, users are:

- Maximizing their Daily Cash rewards: Last year, users earned over $1 billion in Daily Cash from spending on Apple Card.

- Saving for the future and growing their rewards with Savings: The Savings account quickly became a favorite feature among Apple Card users and reached over $10 billion in deposits in just a few short months. Today, the vast majority of users auto-deposit their Daily Cash into Savings, and nearly two-thirds of users have deposited additional funds from a linked bank account to further help them save for the future.2 Today, Savings offers a high-yield APY of 4.50 percent.3

- Making healthy financial decisions with Apple Card’s payment tools: Nearly 30 percent of Apple Card customers make two or more payments per month. Apple Card makes it easier for users to understand and pay their bill, as payments are always due on the last day of the month, and with the help of the interest estimator tool, users can easily view the balance on their card and use the tool to estimate the potential interest in real time so they can make an informed decision before they make a payment.

- Using Apple Card Family to extend healthy finances to the Family Sharing Group: Since its introduction in 2021, more than 1 million Apple Card users share Apple Card with their Family Sharing Group through Apple Card Family, and nearly 600,000 users are building credit equally with their spouses, partners, or another trusted adult on Apple Card.4

- Utilizing Path to Apple Card to extend their access to credit: Since its introduction, over 200,000 users and counting have been approved for an Apple Card after enrolling in the Path to Apple Card program and successfully following the program’s personalized steps, which are designed to improve a user’s financial health.

- Enjoying the privacy and security of Apple Card: Built with the privacy and security of iPhone, and unique features such as Advanced Fraud Protection, Apple Card offers real-time fraud protection, and in 2024 was recognized as the Best Credit Card for Privacy by Bankrate.

Built into Wallet on iPhone, Apple Card has transformed the credit card experience by offering easy-to-use digital tools, creating even more ways users can get the most out of their rewards, and helping customers build and extend healthy financial habits — all while offering the privacy and security users expect from Apple.

Apple Card was also named the Best Co-Branded Credit Card for Customer Satisfaction with No Annual Fee in the J.D. Power 2023 U.S. Credit Card Satisfaction Study, marking the third consecutive year Apple Card and issuer Goldman Sachs have been recognized by J.D. Power with a No. 1 ranking in their segment in the U.S. Credit Card Satisfaction Study.5

More information about Apple Card is available at apple.com/apple-card.

Share article

Media

-

Text of this article

- Apple Card and Savings accounts are issued or provided by Goldman Sachs Bank USA, Salt Lake City Branch. Member FDIC. Savings is available to Apple Card owners and co-owners, subject to eligibility requirements.

- Transfers may be subject to limitations; please see the Deposit Account Agreement at goldmansachs.com/terms-and-conditions/Deposits-Account-Agreement.pdf for more information.

- Annual Percentage Yield (APY) is 4.50 percent as of January 27, 2024. APY may change at any time. Maximum balance limits apply. Savings is available with iOS 16.4 and later.

- Apple Card Family participants and co-owners do not need to have a familial relationship, but must be part of the same Apple Family Sharing Group.

- Apple Card, issued by Goldman Sachs, received the highest score in the Co-Brand Credit Cards – No Annual Fee segment (excluding airline cards) of the J.D. Power 2023 U.S. Credit Card Satisfaction Study, which profiles the experiences of customers from the largest credit card issuers. Goldman Sachs received the highest score among midsize credit card issuers in the J.D. Power 2021-2022 U.S. Credit Card Satisfaction Studies. Visit jdpower.com/awards for more details.